Table of Contents

-

- 1. Overtrading – The Trader’s Pitfall

- 2. Over-Leveraging – A Double-Edged Sword

- 3. Emotional Trading – Letting Feelings Guide Your Decisions

- 4. Lack Of Strategy – Navigating Without A Map

- 5. Undisciplined Trading – Breaking The Rules

- 6. Undercapitalized Trading – Fighting A Battle Without Enough Ammo

- 7. Lack Of Market Knowledge – Ignorance Isn’t Bliss

As the world of trading expands, an increasing number of people are venturing into forex markets. However, stepping into this realm isn’t free of risks. It requires more than just basic knowledge, it demands strategy, discipline, and above all, awareness of the pitfalls that could result in a heavy blow to your investments. This article will highlight seven common mistakes you should avoid when trading, and offer insightful solutions to overcome them.

1. Overtrading – The Trader’s Pitfall

Overtrading is among the most common mistakes to avoid in trading. It occurs when a trader excessively buys and sells in the hope of capitalizing on every market movement. The problem with this approach is that it often leads to reduced focus, hasty decisions, and in most cases, significant financial loss. To avoid overtrading, establish clear trading objectives, stick to your strategy, and don’t let greed drive your actions. More info Overtrading on the web.

2. Over-Leveraging – A Double-Edged Sword

Leverage in forex trading is a powerful tool that allows traders to control larger positions with a smaller amount of money. However, over-leveraging is a risky business and one of the biggest downfalls traders should avoid. The solution? Understand that leverage is a double-edged sword. It can multiply your profits, but it can also magnify your losses. Always manage your risk, keep the leverage to a reasonable level, and never trade money you cannot afford to lose.

3. Emotional Trading – Letting Feelings Guide Your Decisions

When it comes to trading, emotions are your worst enemy. Panic, excitement, fear, and greed can cloud your judgment, causing you to make irrational decisions. This is why emotional trading is a common mistake when trading. To overcome this pitfall, traders must create and stick to a well-defined trading plan. This allows you to make decisions based on logic and strategy, not on fleeting emotions.

4. Lack Of Strategy – Navigating Without A Map

Imagine venturing into the wilderness without a map. The chances of getting lost are high, right? Similarly, trading without a strategy is one of the most significant disadvantages every trader should avoid. To navigate the volatile forex markets successfully, you need a strategy that guides your trading decisions, helps manage your risk, and keeps you focused on your financial goals.

5. Undisciplined Trading – Breaking The Rules

Even the best trading strategy won’t yield results if you lack discipline. Failing to adhere to your trading plan, neglecting stop-loss orders, and disregarding risk management rules are all signs of undisciplined trading. The solution? Cultivate self-control. Stick to your strategy, maintain your risk-reward ratio, and keep emotions out of your trading decisions.

6. Undercapitalized Trading – Fighting A Battle Without Enough Ammo

Just as a soldier needs enough ammunition to fight a battle, a trader needs adequate capital to make profitable trades. Undercapitalized trading is a pitfall that can lead to significant losses. To avoid this, ensure that you have sufficient capital to withstand market fluctuations and sustain potential losses. This will give you staying power in the forex market and provide a cushion against any unforeseen downturns.

7. Lack Of Market Knowledge – Ignorance Isn’t Bliss

Trading isn’t a game of chance, it’s a game of skill, and knowledge is your best weapon. A lack of market knowledge is a significant trading mistake. To overcome this pitfall, learn about the forex market, understand economic indicators, and follow market trends. This will enable you to make informed trading decisions and help you identify when you should avoid trading. Read about How To Create An Infallible Forex Trading System.

Remember, trading is a marathon, not a sprint. It requires patience, discipline, and a continual learning mindset. Avoiding these seven common pitfalls won’t guarantee success, but it will put you on a path toward becoming a more confident, informed, and profitable trader.

Pros And Cons Of Trading In The Forex Market

Below are some of the advantages and disadvantages associated with trading in the forex market:

Pros

1. 24-Hour Market: One of the biggest advantages of the forex market is its availability 24 hours a day, five days a week. This provides flexibility for traders around the world to trade anytime they want.

2. High Liquidity: The forex market is the most liquid in the world, with daily trading volume exceeding $6 trillion. This high liquidity allows traders to enter and exit positions easily.

3. Potential Profit In Both Directions: The forex market provides an opportunity for traders to profit whether the market is going up (buying) or down (selling).

4. Leverage: Forex offers high leverage, which means traders can control positions that are much larger than their capital. This can increase potential profits but also increases risk.

5. Decentralized Market: Since forex is not a centralized market, this can provide more trading opportunities. Opening and closing schedules like stock markets do not bind traders.

Cons

1. Leverage Risk: While leverage can increase potential profits, it can also amplify losses. If the market moves against your position, losses can exceed your initial investment.

2. Market Volatility: The forex market is known to be highly volatile. Sharp and quick price movements can result in large losses in a short amount of time.

3. Market Complexity: The forex market is a global market influenced by various factors, including economic, political, and social events from around the world. This makes analyzing and predicting market movements complex and difficult.

4. Emotional Risk: Forex trading can cause stress and high emotions, especially when traders face losses. Good emotional control and risk management are crucial for success in forex trading.

5. Scams And Fraud: Like other financial markets, the forex market is also susceptible to scams and fraud. Traders should be cautious when choosing their broker and trading platform.

Understanding these pros and cons will help you make better decisions and develop a successful trading strategy in the forex market.

From the collective insight derived from the articles provided and our discussion, the key takeaways for trading in the forex market can be concluded as follows:

1. Trading Strategy: Having a solid trading strategy is essential. This strategy should include clear entry and exit points, risk-reward ratio, and money management rules.

2. Risk Management: Forex trading involves substantial risk. As such, understanding and practicing effective risk management strategies, such as setting stop-loss and take-profit levels, is crucial.

3. Emotional Control: Emotion-led decisions can lead to poor trading choices. Successful traders manage their emotions effectively and make decisions based on their trading plan, not on fear or greed.

4. Leverage: While leverage can multiply profits, it can also amplify losses. It’s important to use leverage responsibly and understand the risks associated with it.

5. Education: Continuous learning is essential in forex trading. The forex market is influenced by various global events, so staying informed about these and how they affect market conditions is key.

6. Capital: Ensure to trade with the capital you can afford to lose. Starting with enough capital is important, but it should never be money that you can’t afford to lose.

7. Broker: Choosing a reliable and regulated broker is crucial to safeguard your investment.

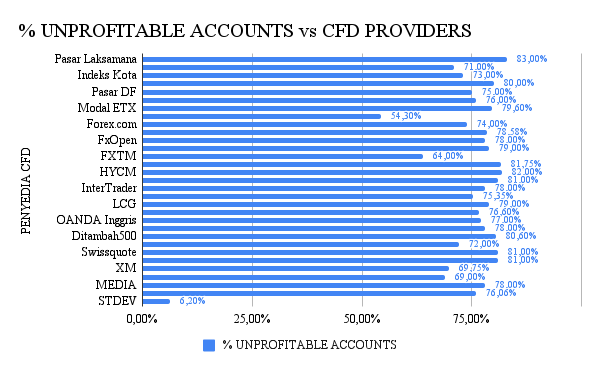

Retail Traders’ Capital Loss Rate: An In-Depth Look

The financial market, particularly in forex and cryptocurrencies, is notorious for its volatility and unpredictability. Unfortunately, retail traders often bear the brunt of these unstable conditions, resulting in a high rate of capital loss. This phenomenon has been statistically supported by numerous studies and is a topic of great concern in the financial world.

Referring to the article published on BabyPips, it was found that nearly 80% of retail traders do not generate profits in their trades. This is a significant statistic that indicates the challenges faced by retail traders in the financial market.

The data highlights the fact that the majority of retail traders have not been able to achieve profitable results in their trading activities. Several factors contribute to this high failure rate, including a lack of understanding of market dynamics, insufficiently solid trading plans, and a tendency to make emotionally-driven trading decisions.

The article emphasizes the importance of adequate education, the development of effective trading strategies, and proper risk management to enhance the chances of success in the financial market. With a deep understanding and good discipline, retail traders can increase their opportunities to generate consistent profits in the long run.

Below is a graphical chart I obtained from the babypips.com article that shows the percentage of losing accounts for each specific CFD provider:

Conclusion:

Forex trading can be a profitable venture if approached with discipline, education, and proper risk management. However, it’s also fraught with risk, and every potential trader should educate themselves thoroughly before diving in. Make sure to understand the market, have a well-tested trading plan, maintain discipline in following it, and be patient – successful trading is a marathon, not a sprint.