Table of Contents

The Origin Of MetaTrader

MetaTrader is an electronic trading platform widely used by traders in the financial markets, especially in the foreign exchange (forex) market. The platform was developed by a Russian company called MetaQuotes Software Corp. MetaTrader was first introduced in 2002 with the launch of MetaTrader 3. However, the real success of MetaTrader began with the release of its fourth version, MetaTrader 4 (MT4), in 2005. MT4 offered various features and tools that were highly useful for traders, such as interactive charts, technical indicators, automated scripts, and the ability to engage in automated trading using Expert Advisors (EAs). Click here for more info on MetaTrader on the web.

MetaTrader 4 gained remarkable popularity among retail and institutional traders due to its user-friendly interface, flexibility, and ability to access global financial markets. The platform allowed traders to perform technical analysis, execute real-time trades, manage positions, and efficiently monitor their portfolios. Since its launch, MetaQuotes has continued to develop the MetaTrader trading platform. In 2010, they released MetaTrader 5 (MT5) as an advanced version of MT4. MT5 offered more advanced features, including the ability to trade a variety of financial instruments such as stocks, commodities, and derivatives. However, despite the introduction of various new features in MT5, MT4 remained the most popular platform among traders.

Why Do Many Brokers Use MetaTrader?

There are several reasons why many brokers use MetaTrader as their trading platform:

Popularity And Recognition: MetaTrader has become a highly popular trading platform among traders. Many traders are familiar with and accustomed to the MetaTrader interface, making it easier for them to switch or choose brokers using this platform. The use of MetaTrader also provides confidence to traders as the platform has proven to be reliable and efficient in executing trades.

Powerful Capabilities: MetaTrader offers a wide range of powerful trading features and tools. The platform is equipped with interactive charts, technical indicators, analytical tools, and the ability to automate trades using Expert Advisors (EAs). Additionally, MetaTrader can access various financial markets, including forex, stocks, commodities, and derivatives. This broad capability allows brokers to offer a variety of instruments and provide flexibility to traders.

User-Friendliness: The MetaTrader interface is relatively easy to use and intuitive. Even novice traders can quickly understand how to use the platform. Moreover, MetaTrader provides various customizable settings according to traders’ preferences and needs. This user-friendliness allows traders to focus on their trading without dealing with complicated technical obstacles.

Support For Automated Trading: MetaTrader supports the use of Expert Advisors (EAs), enabling traders to engage in automated trading. With EAs, traders can create trading algorithms and strategies or utilize existing EAs to automate trade execution. This feature is particularly popular among traders interested in automated trading and programming.

Strong Ecosystem And Community: MetaTrader has a strong ecosystem and community surrounding it. There are various forums, websites, and other online resources dedicated to MetaTrader, where traders can share knowledge, strategies, and indicators. This creates a supportive environment for traders and facilitates the exchange of information and collaboration among them.

The MetaTrader Platform

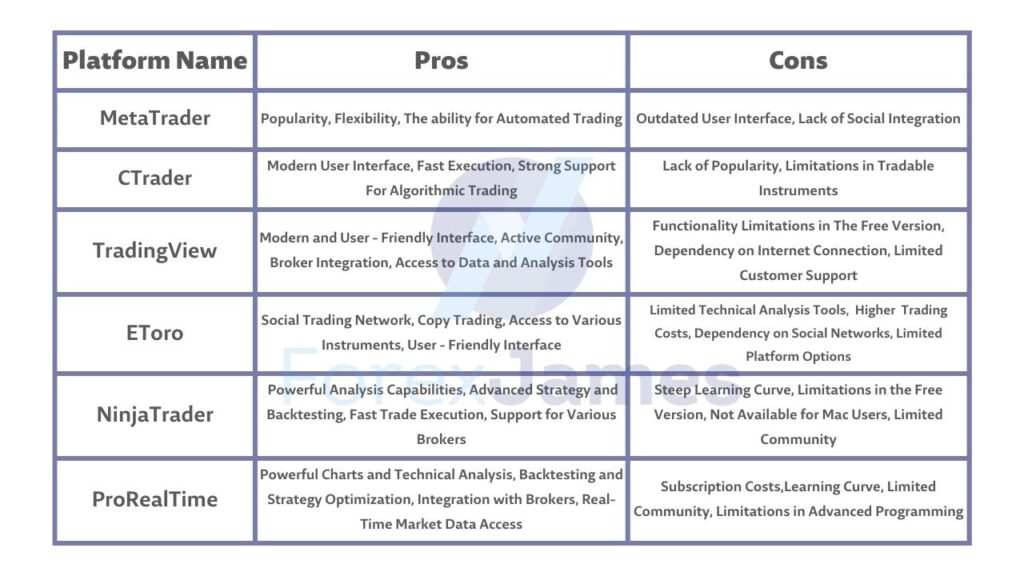

Pros Of MetaTrader:

Popularity: MetaTrader has become a widely used and popular trading platform worldwide. Many traders are familiar with the MetaTrader interface and have access to various resources and indicators developed specifically for this platform.

Flexibility: MetaTrader offers high flexibility in terms of tradable financial instruments. The platform can be used for trading in the forex market, stocks, commodities, and other derivatives. This feature allows traders to diversify their portfolios and access various trading opportunities.

The Ability For Automated Trading: MetaTrader can use Expert Advisors (EAs) for automated trading. By using the MQL programming language, traders can create automated trading systems or use existing EAs to execute trades based on predetermined algorithms.

Cons Of MetaTrader:

Outdated User Interface: Although MetaTrader offers powerful functionality, the user interface may not always have a modern look and can feel somewhat outdated compared to some other trading platforms.

Lack Of Social Integration: MetaTrader lacks strong social integration features. This means that traders cannot easily share ideas, knowledge, or trades with other traders within the platform.

The CTrader Platform

CTrader is an electronic trading platform designed for traders in the financial markets. The platform is developed by a software company called Spotware Systems Ltd. CTrader offers a modern user interface, fast execution, and support for algorithmic trading.

Pros Of CTrader:

Modern User Interface: CTrader features a modern and intuitive user interface. The platform offers interactive charts, customizable layouts, and easy navigation, making it easier for traders to use and navigate.

Fast Execution: CTrader is known for its fast and stable execution. Fast execution is crucial in trading, and CTrader has been recognized for its reliable performance in this aspect.

Strong Support For Algorithmic Trading: CTrader provides a powerful programming environment using the C# programming language. This allows traders to develop complex automated trading strategies, such as trading robots or other automated trading systems.

Cons Of CTrader:

Lack Of Popularity: CTrader is not as popular as MetaTrader and is not available with all brokers. This can create limitations in terms of accessibility and community support compared to more widely used platforms.

Limitations In Tradable Instruments: Some brokers using CTrader may have limitations on the financial instruments that can be traded. Generally, CTrader is more commonly used in forex trading compared to other markets such as stocks or commodities.

It’s important to note that the choice of the best trading platform depends on individual preferences and needs. Each platform has its advantages and disadvantages, and it’s important to research and try out different platforms directly before making the right decision for your trading needs.

The TradingView Platform:

Tradingview is freely available on the net. It is browser-based and it can be downloaded as well onto your computer as software or an app.

Pros Of TradingView:

Modern And User-Friendly Interface: TradingView offers a modern, visually appealing, and user-friendly interface. The platform provides feature-rich interactive charts, powerful technical analysis tools, and customizable layouts. This makes the platform intuitive to use and helps traders in analyzing the market.

Active Community: TradingView has a large and active community within the platform. Traders can easily interact with other members, share trading ideas, and gain insights from shared analyses. This creates a collaborative environment and facilitates knowledge exchange among traders.

Broker Integration: TradingView offers integration with several leading brokers. This allows traders to execute trades directly from the TradingView platform, monitor their positions, and manage their portfolios more efficiently. This integration simplifies the trading process and helps traders make decisions more quickly.

Access To Data And Analysis Tools: TradingView provides easy access to a wide range of market data and presents sophisticated interactive charts. Traders can easily access historical and real-time data and comprehensive technical analysis tools. The platform also offers various technical indicators, drawing tools, and other analysis features to assist traders in identifying trading opportunities.

Cons Of TradingView:

Functionality Limitations In The Free Version: While TradingView offers a feature-rich free version, there are some limitations compared to the paid version. Some more advanced indicators and analysis tools may only be available in the paid version.

Dependency On Internet Connection: TradingView is a web-based platform that requires a stable Internet connection. If the internet connection is disrupted, access to data and trading functions can be affected.

Limited Customer Support: TradingView’s customer support can be perceived as less responsive and limited. Some users have reported delays in receiving responses or assistance from the support team.

The EToro Platform

The EToro platform is a social trading platform that allows users to participate in financial trading and connect with a social network of other traders. The platform combines flexible trading, advanced analytical tools, social networking features, and the ability to copy trades from successful traders.

Pros Of EToro:

Social Trading Network: One of the main advantages of eToro is its strong social trading feature, allowing traders to connect with others, share trading ideas, and follow or copy trades from more experienced traders. This feature provides an opportunity to learn from successful traders and leverage collective wisdom in trading decision-making.

Copy Trading: eToro provides a copy trading feature that allows traders to automatically copy trades from other traders. This is useful for less experienced traders or those with limited time and knowledge to perform their market analysis. With copy trading, they can follow and replicate trades from successful traders.

Access To Various Instruments: eToro offers access to a wide range of financial instruments, including stocks, forex, commodities, indices, and cryptocurrencies. This allows traders to diversify their portfolios and access various market trading opportunities.

User-Friendly Interface: eToro has an intuitive and user-friendly interface. The platform is designed to be easy to use, especially for beginner traders. eToro provides interactive charts, technical analysis tools, and user-friendly trading features.

Cons Of EToro:

Limited Technical Analysis Tools: Although eToro provides some basic technical analysis tools, the platform may not be as comprehensive as other trading platforms. Some more experienced traders may feel the lack of more advanced analysis tools is a limitation.

Higher Trading Costs: eToro is known to have relatively higher trading costs compared to some other brokers. Wider spreads and commissions on certain assets can affect trading results and profits.

Dependency On Social Network: While eToro’s social network feature can be an advantage, there are also risks associated with relying on the knowledge and trading decisions of others. Traders need to conduct their research and be cautious in selecting traders to copy, as past performance does not guarantee future results.

Limited Platform Options: eToro has its proprietary trading platform and does not provide many other platform options like MetaTrader or cTrader. This can be a limitation for traders who prefer to use a specific trading platform.

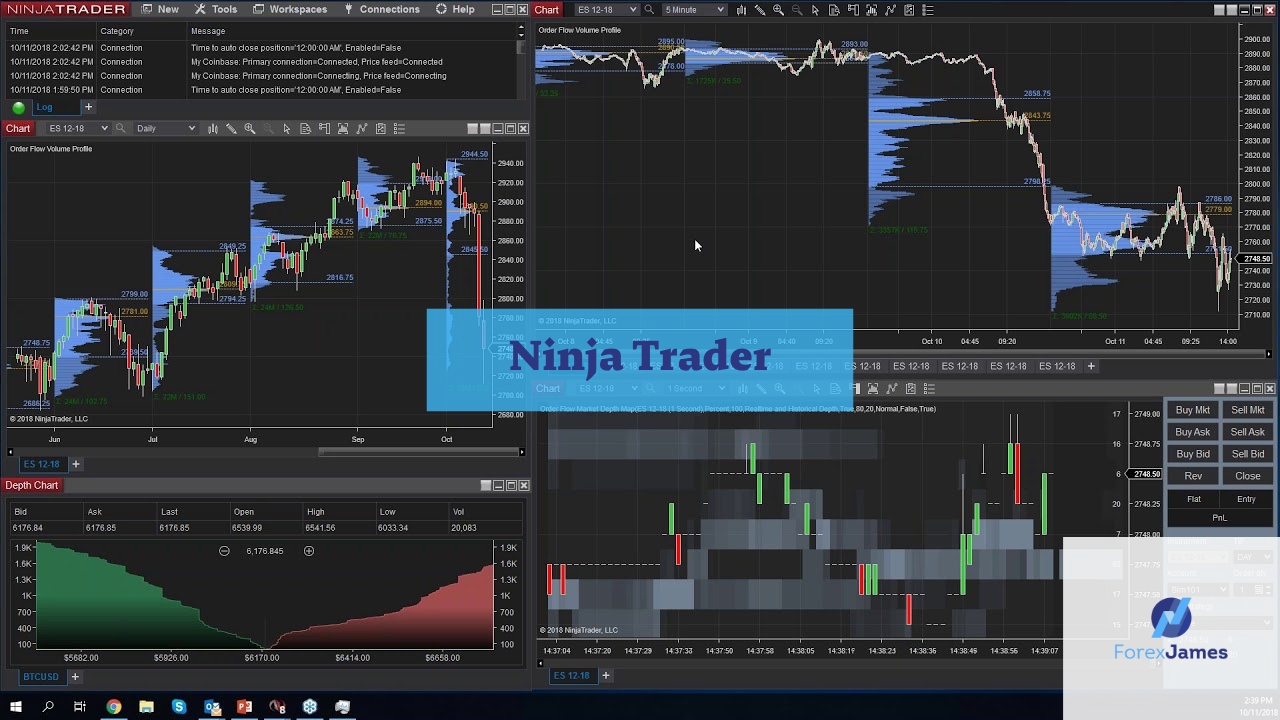

The Ninjatrader Platform

NinjaTrader is a popular and advanced electronic trading platform used by traders for market analysis, trade execution, and risk management. The platform is designed for active traders and institutions seeking powerful and innovative tools to manage their trades. It also offers support for the development and testing of custom trading strategies through the NinjaScript programming language. Traders with programming knowledge can create custom indicators and trading algorithms according to their preferences.

Pros Of NinjaTrader:

Powerful Analysis Capabilities: NinjaTrader offers a wide range of powerful and comprehensive technical analysis tools. The platform is equipped with interactive charts, indicators, drawing tools, and in-depth analysis capabilities. This allows traders to conduct in-depth market analysis and identify potential trading opportunities.

Advanced Strategy And Backtesting: NinjaTrader provides a strong strategy development environment that allows traders to create and test their trading strategies. The platform also offers advanced backtesting features, allowing traders to test their strategies using historical data to evaluate the performance and reliability of their strategies before implementing them in live trading.

Fast Trade Execution: NinjaTrader is known for its short and stable trade execution. The platform is designed to minimize latency and provide good performance when executing trades, especially for active traders or those using shorter-term time-based trading strategies.

Support For Various Brokers: NinjaTrader has partnerships with several leading brokers, giving traders the option to choose a broker that suits their needs. This provides flexibility in selecting a broker that provides desired trading conditions.

Cons Of NinjaTrader:

Steep Learning Curve: NinjaTrader has a relatively steep learning curve, especially for novice traders or those who are not familiar with more complex trading platforms. The use of advanced features and strategy development may require additional time and effort to fully understand.

Limitations In The Free Version: Although NinjaTrader offers a free version of its platform, the free version has some limitations. Some more advanced features and analysis tools may only be available in the paid version or through additional subscription fees.

Not Available For Mac Users: NinjaTrader is primarily available for Windows users. Mac users need to use additional programs such as Boot Camp or Parallels to run NinjaTrader on their computers.

Limited Community: While NinjaTrader has a loyal user community, this community may not be as large and active as other trading platforms like MetaTrader or TradingView. This can limit access to discussions and collaboration with other traders.

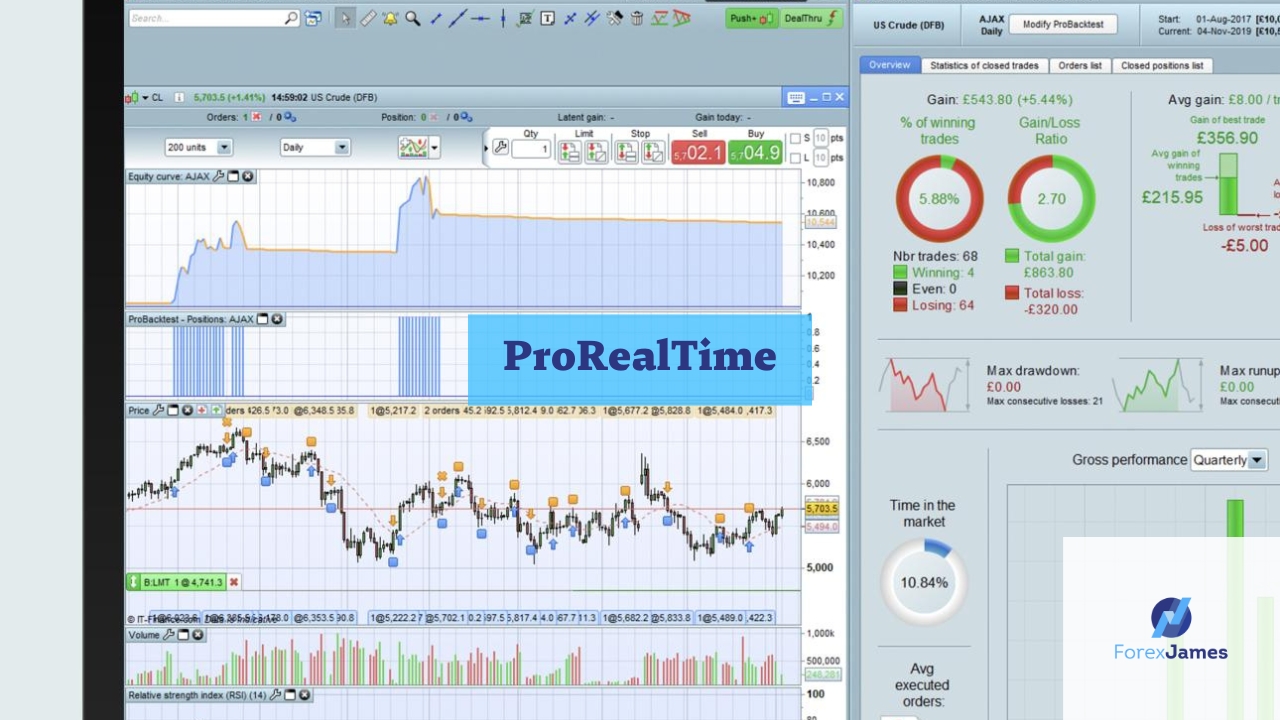

The ProRealTime Platform

Pro Of ProRealTime:

Powerful Charts And Technical Analysis: ProRealTime offers feature-rich interactive charts and comprehensive technical analysis tools. The platform is equipped with various chart types, indicators, and drawing tools that can assist traders in analyzing the market and identifying trading opportunities.

Backtesting And Strategy Optimization: ProRealTime provides advanced backtesting features, allowing traders to test their trading strategies using historical data. The platform also offers the ability to optimize strategy parameters, helping traders develop and improve their trading systems.

Integration With Brokers: ProRealTime supports integration with several leading brokers. This enables traders to trade directly from the ProRealTime platform and manage their portfolios more efficiently.

Real-Time Market Data Access: The platform provides real-time access to accurate and up-to-date market data. This allows traders to track price movements in real-time and make more timely trading decisions.

Cons Of ProRealTime:

Subscription Costs: ProRealTime is a paid platform that requires monthly or annual subscription fees. These costs can be a barrier for traders with limited budgets or those who are new to trading.

Learning Curve: Like any advanced trading platform, ProRealTime has a steep learning curve. New or inexperienced traders may require extra time and effort to learn the functionality and features available.

Limited Community: ProRealTime does not have as large or active a user community as other trading platforms. This can limit traders’ access to discussions, idea sharing, and collaboration with other traders.

Limitations In Advanced Programming: Although ProRealTime provides a programming language that allows for the development of custom indicators and trading systems, the platform may have limitations in more advanced or complex programming.

Conclusion – What Is The Trading Platform Of Your Choice?

MetaTrader

In conclusion, it can be inferred that MetaTrader was born out of the traders’ need for a reliable, efficient, and dependable trading platform. With its intuitive interface, powerful features, and widespread support from leading brokers, MetaTrader has become the top choice for many traders in the global financial markets.

CTrader

The conclusion that can be drawn about MetaTrader and cTrader depends on each trader’s personal preferences and trading needs. MetaTrader is suitable for those who want a popular, flexible platform that supports automated trading, while cTrader may appeal to those seeking a more modern interface and fast execution support.

TradingView

The choice to use TradingView as a trading platform depends on traders’ preferences and individual needs. The main attractions are its modern interface, active community, integration with brokers, and access to comprehensive data and analysis tools. However, traders need to consider the limitations of the free version’s functionality, dependence on an internet connection, and limited customer support as potential drawbacks.

EToro

For the use of eToro, there are many advantages we can gain, such as the social network feature, copy trading, access to various instruments, and user-friendly interface, which can be the main attractions. However, traders need to consider limitations in technical analysis tools, higher trading costs, reliance on social networks, and limited platform options as potential drawbacks.

NinjaTrader

The conclusion that can be drawn is that using the NinjaTrader trading platform depends on the preferences and needs of individual traders. The main attractions are its strong analytical capabilities, advanced strategy development and backtesting, fast trade execution, and support for various brokers. However, traders need to consider the steep learning curve, limitations in the free version, restrictions on Mac platforms, and a less extensive community as potential drawbacks.

ProRealTime

For the use of ProRealTime, there are many advantages we can gain, such as powerful charting and technical analysis, backtesting, and strategy optimization features, integration with brokers, and access to real-time market data, which can be the main attractions. However, traders need to consider subscription costs, the required learning curve, a limited community, and limitations in advanced programming as potential drawbacks.