Table of Contents

In the world of forex trading, protecting your investments is crucial. Unfortunately, there are scam forex brokers out there who engage in fraudulent activities and can cause significant financial losses. To safeguard your investments, it is essential to understand what makes a broker a scam, identify reliable review sites, and know the importance of broker regulation. This article aims to provide insights and guidance in navigating this landscape effectively.

What Makes A Broker A Scam?

1. Unregulated Operations: One of the key indicators of a scam forex broker is operating without proper regulation. Legitimate brokers are required to be licensed and regulated by reputable financial authorities. Scam brokers often lack regulation or operate under questionable jurisdictions, making it risky to entrust them with your investments.

2. Misleading Marketing And Promises: Scam brokers often employ deceptive marketing tactics, making unrealistic claims about profit potential or guaranteed returns. They may use aggressive sales techniques or manipulate trading results to attract unsuspecting traders. It is important to be cautious of brokers who promise quick riches without emphasizing the risks involved in forex trading.

3. Withdrawal Issues And Account Manipulation: Another common characteristic of scam brokers is difficulty in withdrawing funds or account manipulation. They may create obstacles or delay withdrawal requests, leading to frustration and potential loss of funds. Additionally, scam brokers might manipulate trades, prices, or spreads to their advantage, adversely affecting your trading outcomes.

Reliable Review Sites

Source: neilpatel.com

When evaluating forex brokers, relying on trustworthy review sites can provide valuable insights. Look for the following qualities in review sites:

1. Independence And Unbiased Reviews: Reliable review sites prioritize providing unbiased information and evaluations. They conduct thorough research and analysis to offer an objective assessment of brokers. Look for sites that disclose their reviewing methodology and avoid those with potential conflicts of interest.

2. Credibility And Reputation: Choose review sites with a strong reputation and credibility in the industry. Look for established platforms with a track record of providing accurate and reliable information. It is advisable to consider multiple review sites and compare their findings to form a well-rounded perspective.

3. User Reviews And Community Feedback: Pay attention to user reviews and feedback on review sites. Genuine user experiences can provide valuable insights into the quality and reliability of a broker. However, be mindful of potentially fake reviews or biased opinions. Consider the overall consensus and patterns among user feedback.

Here Are Some Examples Of Reputable Review Sites In The Forex Industry:

1. Forex Peace Army (forexpeacearmy.com): This site provides reviews and ratings of forex brokers, as well as a discussion forum for users to share their experiences. Forex Peace Army is known for its credibility and has a large number of reviews from different traders.

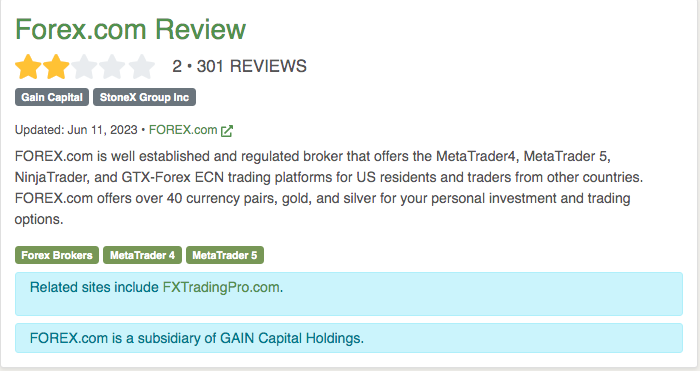

Here is an example review of Forex Peace Army (forexpeacearmy.com):

Source: Forex Peace Army

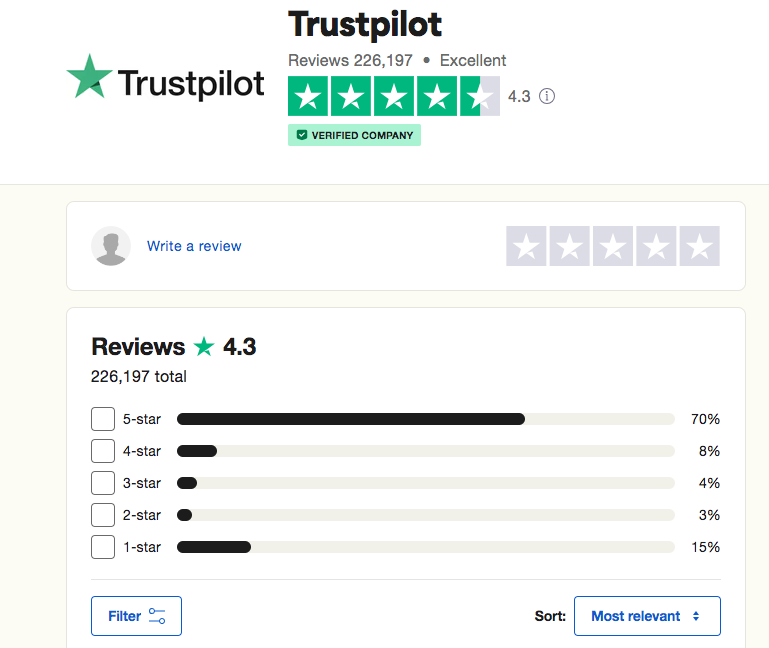

2. Trustpilot (trustpilot.com): Trustpilot is a consumer review platform that covers various industries, including forex. You can find reviews and ratings of forex brokers by users who have previously used their services.

Here is an example review of Trustpilot (trustpilot.com):

Source: Trustpilot

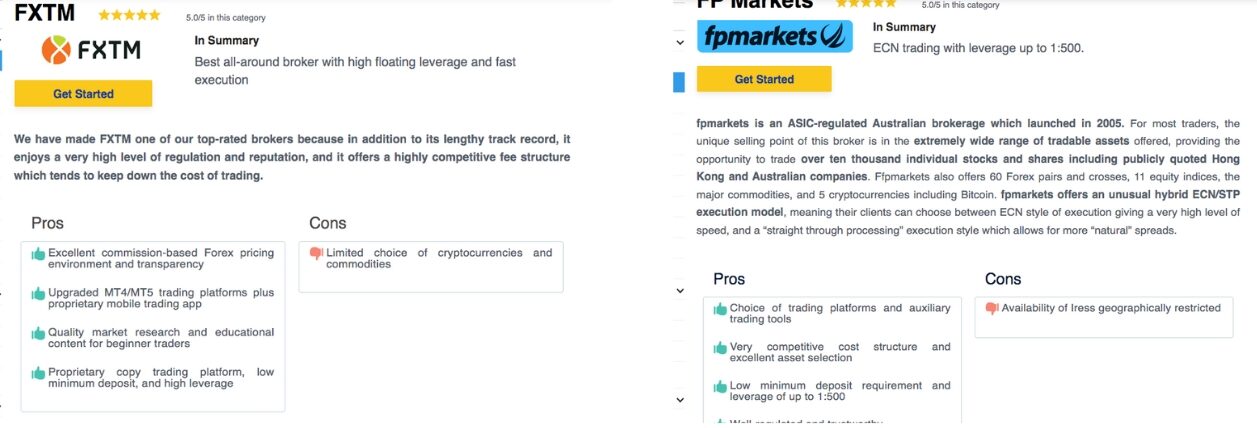

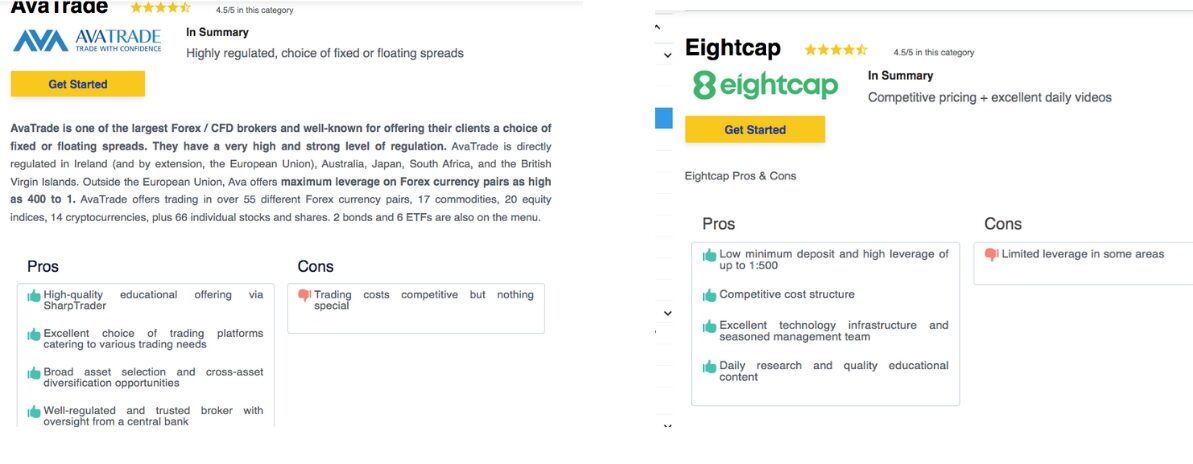

3. Forex Broker Reviews (forexbrokerreviews.com): This site offers reviews and comparisons of forex brokers, including information about trading platforms, features, and services offered. They also provide ratings to help traders choose a broker that suits their needs.

Here is an example review of Forex Broker Reviews (forexbrokerreviews.com):

Source: dailyforex.com

Source: dailyforex.com

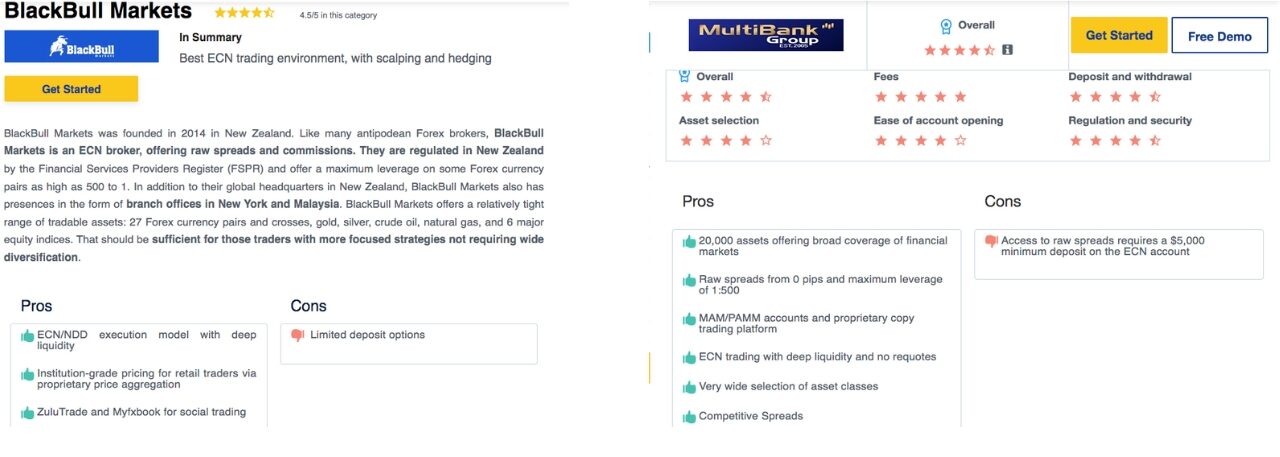

4. Investing (investing.com): Investing.com is a financial news and analysis website that also provides forex broker reviews. They have a dedicated section for user reviews, where traders can give ratings and comments about the brokers they have used.

Here is an example review of Investing.com (investing.com):

Source: Trustpilot

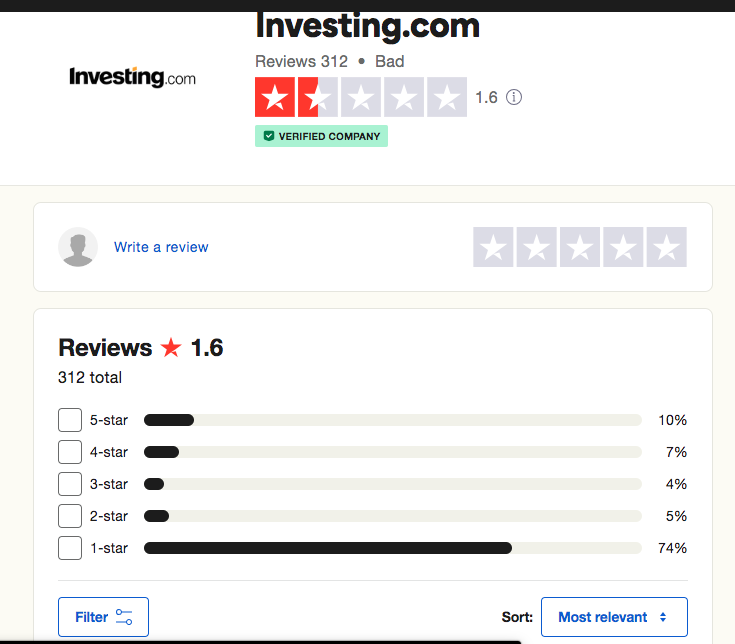

5. DailyForex (dailyforex.com): This site provides in-depth reviews and analysis of forex brokers, market news, and trading strategies. They have a dedicated team of analysts who evaluate brokers and provide comprehensive guidance for traders.

Source: Trustpilot

Are The Brokers Regulated?

Broker regulation is a vital aspect to consider when choosing a forex broker. Regulation ensures that brokers adhere to specific standards, safeguard client funds, and operate transparently and fairly. Look for brokers regulated by reputable financial authorities such as:

1. Financial Conduct Authority (FCA) – United Kingdom

2. Australian Securities and Investments Commission (ASIC) – Australia

3. Securities and Exchange Commission (SEC) – United States

4. Cyprus Securities and Exchange Commission (CySEC) – Cyprus

Regulatory bodies enforce compliance, conduct regular audits, and provide a channel for dispute resolution. Verify the broker’s regulatory status by checking their website or consulting the regulatory authority’s database.

Safeguarding your investments in the forex market requires awareness and vigilance, particularly when dealing with potential scam forex brokers. Understanding the characteristics that make a broker a scam, relying on reliable review sites, and prioritizing regulated brokers are essential steps in protecting your funds. Conduct thorough research, seek professional advice if needed, and always prioritize transparency, credibility, and regulatory compliance when choosing a forex broker. By being diligent and informed, you can confidently navigate the forex trading landscape and protect your investments from fraudulent activities.

Building Forex Trading Knowledge And Skills

To protect your investments and navigate the landscape of scam forex brokers effectively, it is crucial to educate yourself about forex trading. Here’s why building forex trading knowledge and skills is essential:

1. Understanding Market Dynamics: Forex trading involves complex market dynamics, including factors such as economic indicators, geopolitical events, and market sentiment. By educating yourself about these factors, you can make informed trading decisions and better analyze market trends.

Example: Learning about fundamental analysis and how economic news releases can impact currency prices can help you navigate volatile market conditions and avoid potential scams.

2. Technical Analysis Techniques: Familiarizing yourself with technical analysis tools and techniques can enhance your ability to identify potential trading opportunities and assess market trends. Understanding chart patterns, indicators, and support and resistance levels can provide valuable insights for your trading decisions.

Example: Developing proficiency in using tools like moving averages, Fibonacci retracements, and trend lines can help you identify entry and exit points with greater accuracy.

3. Risk Management Strategies: Learning about risk management is crucial for protecting your investments and avoiding scams. Establishing risk management strategies, such as setting stop-loss orders and managing position sizes, can help mitigate potential losses and preserve your trading capital.

Example: Implementing a risk-reward ratio and proper money management techniques can protect you from falling victim to scams and prevent substantial financial losses.

4. Continual Learning And Skill Development: Forex trading is a dynamic field, and stay updated with industry trends, strategies, and best practices is essential. Engage in continuous learning through books, online courses, webinars, and trading communities to enhance your trading skills and adapt to changing market conditions.

Example: Participating in online forums and communities can provide opportunities for knowledge-sharing and learning from experienced traders, enabling you to stay informed about potential scams and fraudulent activities.

Educating yourself about forex trading is a vital component of safeguarding your investments and navigating the landscape of scam forex brokers. By understanding market dynamics, technical analysis techniques, and risk management strategies, and engaging in continual learning, you can enhance your trading skills and make informed decisions. Remember, building knowledge and skills is an ongoing process, and staying informed is crucial to protect your investments and avoid falling victim to scams in the forex market.

Conclusion

Securing your investments in forex trading and navigating the world of scam forex brokers is crucial. In this article, we have discussed several important points related to this topic. Here are some conclusions that can be drawn:

1. Differentiating Scam Brokers: It is important to understand what makes a broker considered a scam. Some warning signs to watch out for include unrealistic profit promises, lack of regulation, trapping practices, and lack of transparency. Conducting research and reading independent reviews can help you identify scam brokers.

2. Reliability Of Review Sites: Several review sites can be used as a reference to evaluate the reliability of forex brokers. However, it is essential to ensure that these review sites have a good reputation, use objective evaluation methods, and gather opinions from various trusted sources.

3. Broker Regulation: Choosing a forex broker regulated by reputable financial authorities is an important step to protect your investments. Regulation ensures that brokers adhere to certain standards and comply with established regulations. Confirming a broker’s regulation before opening an account can provide additional confidence and protection.

4. Self-Education: Building knowledge and skills in forex trading is crucial to protect your investments. Understanding market dynamics, technical analysis techniques, and risk management strategies, and continuously learning and developing trading skills can help you make better trading decisions and avoid scams.

By combining an understanding of what makes a broker a scam, using reliable review sites, choosing regulated brokers, and strengthening your knowledge and trading skills, you can safeguard your investments and avoid scams in forex trading. Remember that awareness and continuous updates are key to protecting your investments and avoiding falling victim to scams in the forex market.