Table of Contents

- 1. The Origin Of The Turtle Traders

- 2. The Breakout Trading System

- 3. Training And Implementation

- 4. Following The Rules

- 5. Success And Legacy

- 6. Lessons For Traders

- 7. Principles Of The Breakout Trading System

- 8. Challenges Faced By The Turtle Traders

- 9. Evolution Of Breakout Trading Strategies

- 10. Applying Breakout Strategies In Today’s Markets

- 11. Criticisms And Controversies Surrounding The Turtle Experiment

- 12. Lessons From The Turtle Traders For Retail Traders

- 13. Psychology And Discipline In Breakout Trading

- 14. Backtesting And Optimization Of Breakout Strategies

- 15. Risk Management Techniques In Breakout Trading

- 16. Building A Breakout Trading Plan

- 17. Combining Breakout Strategies With Other Technical Analysis Tools

- 18. Long-Term Success And Adaptability In Breakout Trading

- 19. The Role Of Technology In Breakout Trading

- 20. Case Studies And Success Stories Of Breakout Traders

The Turtle Traders is a group of individuals who were taught a breakout trading system that achieved remarkable success. Developed by legendary traders Richard Dennis and William Eckhardt, this system became a game-changer in the world of trading. In this article, we will delve into how the Turtle Traders were trained and the key principles behind their breakout trading strategy.

1. The Origin Of The Turtle Traders

In the early 1980s, Richard Dennis, a successful commodities trader, had a hypothesis that great traders could be trained rather than being born with innate talent. To prove his theory, he recruited a diverse group of individuals, known as the Turtle Traders, through a rigorous selection process.

2. The Breakout Trading System

The core strategy taught to the Turtle Traders was a trend-following breakout system. They were instructed to identify market breakouts and ride the momentum generated by these breakouts. The system was based on a combination of technical indicators, including the Donchian channel and moving averages, to determine entry and exit points.

3. Training And Implementation

The Turtle Traders underwent an intensive training program, where they learned the rules and principles of the breakout trading system. They were taught risk management techniques, position sizing, and the importance of sticking to a disciplined trading plan. Simulated trading was also a crucial part of their training, allowing them to practice implementing the system in real-time market conditions.

4. Following The Rules

One of the key aspects of the Turtle Traders’ success was their strict adherence to the trading rules. They were instructed to follow the system’s signals diligently, without letting emotions or personal biases interfere with their decision-making process. This disciplined approach ensured consistency in their trading and minimized the impact of subjective judgment.

5. Success And Legacy

The Turtle Traders’ breakout system proved to be highly successful, generating substantial profits over the years. Some of the Turtle Traders went on to become legendary traders themselves, further cementing the legacy of this trading experiment. The lessons learned from their experience continue to influence traders and investors around the world.

6. Lessons For Traders

The story of the Turtle Traders offers valuable lessons for traders looking to develop their own successful trading strategies. Some key takeaways include:

– The importance of having a well-defined trading system with clear entry and exit rules.

– The significance of risk management and position sizing in preserving capital.

– The value of discipline and following the trading plan without succumbing to emotions.

– The benefits of backtesting and practicing the trading system in various market conditions.

7. Principles Of The Breakout Trading System

To understand the success of the Turtle Traders’ breakout trading system, it’s important to delve into the key principles that guided their trading approach. These principles include:

– Identifying high-probability breakout opportunities.

– Setting specific entry and exit criteria based on the system’s rules.

– Managing risk through proper position sizing and stop-loss orders.

– Adapting the system to different markets and timeframes.

– Continuous monitoring and adjustment of trading parameters.

8. Challenges Faced By The Turtle Traders

While the Turtle Traders achieved remarkable success, they also encountered challenges along the way. Discussing these challenges, such as market volatility, drawdown periods, and emotional resilience, provides a realistic perspective on the journey of implementing a breakout trading system.

9. Evolution Of Breakout Trading Strategies

The impact of the Turtle Traders’ breakout system can be seen in the evolution of breakout trading strategies. Explore how this trading approach influenced subsequent traders and the development of automated trading systems that utilize breakout methodologies.

10. Applying Breakout Strategies In Today’s Markets

Highlight the relevance and applicability of breakout trading strategies in modern financial markets. Discuss how traders can adapt and implement breakout principles in different asset classes, including stocks, forex, and cryptocurrencies.

Criticisms And Controversies Surrounding The Turtle Experiment

Examine some of the criticisms and controversies surrounding the Turtle Traders experiment. Address misconceptions and shed light on the ongoing debates related to the effectiveness and long-term sustainability of breakout trading systems.

Lessons From The Turtle Traders For Retail Traders

Provide practical takeaways and insights from the Turtle Traders’ experience that can be applied by retail traders. Discuss how individual traders can incorporate breakout strategies into their trading plans, emphasizing the importance of discipline, risk management, and continuous learning.

Psychology And Discipline In Breakout Trading

Explore the psychological aspects and the role of discipline in implementing a breakout trading strategy. Discuss the challenges faced by traders in maintaining discipline, managing emotions, and sticking to the rules of the breakout system.

Backtesting And Optimization Of Breakout Strategies

Highlight the importance of backtesting and optimizing breakout trading strategies. Explain how traders can use historical data to evaluate the performance of their breakout system, make necessary adjustments, and improve its profitability.

Risk Management Techniques In Breakout Trading

Examine various risk management techniques employed by breakout traders. Discuss the use of stop-loss orders, trailing stops, and position-sizing methods to protect capital and minimize losses in breakout trades.

Building A Breakout Trading Plan

Guide readers on how to develop a comprehensive breakout trading plan. Discuss the components of a well-defined trading plan, including entry and exit rules, risk parameters, trade management strategies, and the importance of journaling and reviewing trades.

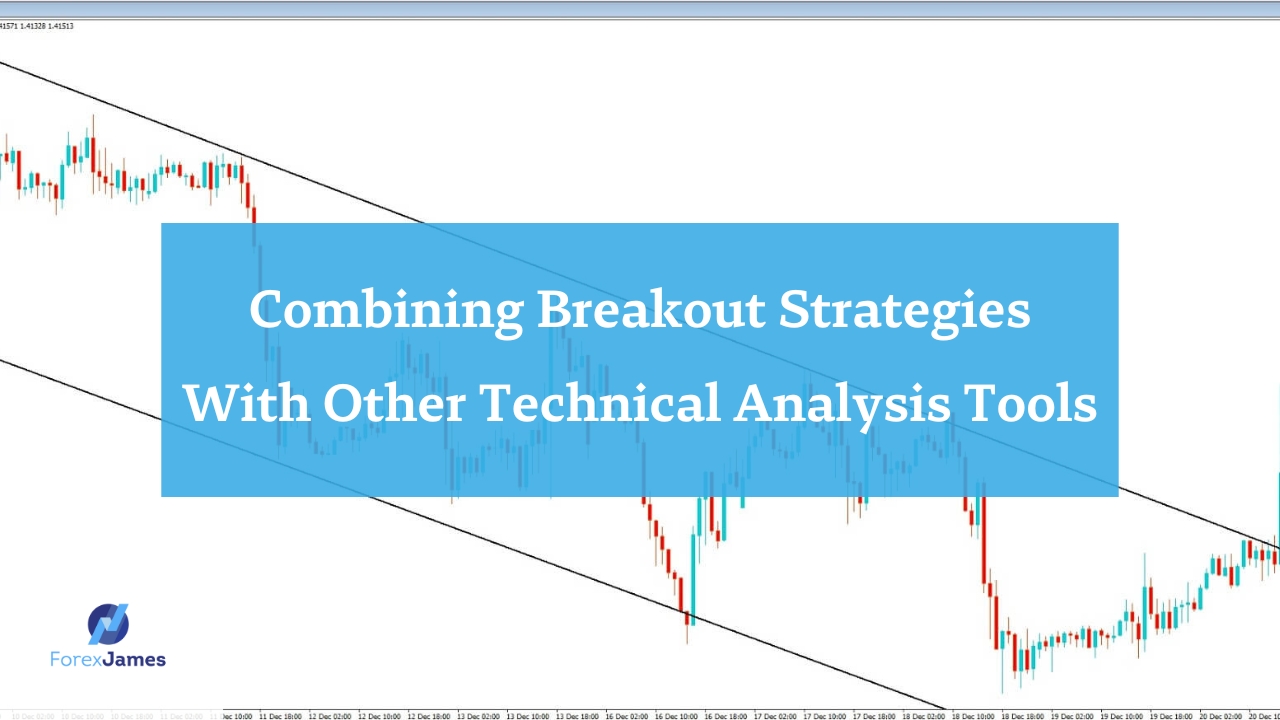

Combining Breakout Strategies With Other Technical Analysis Tools

Explore how traders can enhance their breakout trading approach by incorporating other technical analysis tools. Discuss the complementary use of indicators, chart patterns, and trend analysis to strengthen breakout signals and improve trading accuracy.

Long-Term Success And Adaptability In Breakout Trading

Discuss the importance of long-term success and adaptability in breakout trading. Highlight the need for traders to continually learn, adapt their strategies to changing market conditions, and avoid becoming overly reliant on a single approach.

The Role Of Technology In Breakout Trading

Examine how advancements in technology have influenced breakout trading. Discuss the use of algorithmic trading, automation, and trading software in enhancing the efficiency and execution of breakout strategies.

Case Studies And Success Stories Of Breakout Traders

Share real-life case studies and success stories of traders who have achieved significant success using breakout trading strategies. Highlight their experiences, lessons learned, and key takeaways for aspiring breakout traders.

Conclusion

In this article, we have discussed Turtle Traders, a group of traders who successfully implemented a breakout trading system with remarkable success. They applied important principles such as identifying high-probability breakout opportunities, managing risk effectively, and adapting the system to different markets. The Turtle Traders faced challenges such as market volatility, but discipline and emotional resilience helped them achieve success. Valuable lessons can be learned from their experience, including the importance of psychology, strategy backtesting, and risk management. Despite controversies and criticisms, breakout trading systems remain relevant and applicable in today’s financial markets. With discipline, continuous learning, and the integration of technology, traders can build successful breakout trading plans. Long-term success is supported by adaptability and leveraging current technology. The Turtle Traders serve as a real-life example of how breakout trading strategies can serve as a foundation for trader success.