Table of Contents

- 1. Access To Different Payment Terms

- 2. Risk-Free Trading With Other People’s Money

- 3. Return Of Your Funded Fee

- 4. Learning How To Trade The Forex Market

- 5. Pros And Cons Of Being A Prop Trader

- 6. How Do Prop Firms Work?

- 7. Prop Trading Taxes

- 8. Additional Resources

- 9. Let’s Look At Two Popular Prop Firms For Example

Are you passionate about trading the Forex market but feel like you lack the necessary capital to get started? Joining a prop trading Firm might be the perfect solution for you. Proprietary trading firms, also known as prop firms, offer aspiring traders the opportunity to trade with other people’s money and reap the rewards. In this article, we will explore the reasons why you should consider joining a Prop Firm and how it can benefit your trading journey. Let’s dive in! Read for more info on How To Join a Prop Trading Firm.

1. Access To Different Payment Terms

When you join a prop trading firm, you gain access to various payment terms that can significantly enhance your trading experience. Unlike traditional trading where you solely bear the financial risks, prop firms often offer different compensation models. For instance, some firms provide traders with a profit split, where you receive a percentage of the profits generated from your trades. This model allows you to earn more as you become a more successful trader. Other prop firms may offer a fixed salary or a combination of salary and bonuses. The flexibility in payment terms ensures that traders have options that align with their financial goals and risk tolerance.

2. Risk-Free Trading With Other People’s Money

One of the most enticing aspects of joining a prop trading company is the opportunity to trade with other people’s money. Prop firms provide their traders with capital to trade, which means you don’t have to risk your hard-earned savings. This risk-free trading environment allows you to focus on your trading strategies without the fear of personal financial loss. It’s a unique chance to gain valuable trading experience and refine your skills, all while leveraging the resources provided by the prop firm.

3. Return Of Your Funded Fee

In some prop trading firms, once you are funded and start trading, you have the opportunity to earn back the funded fee that you initially paid to join the firm. This means that the fee you invested becomes a trading stake, and as you generate profits, a portion is allocated towards recovering your initial payment. This setup not only gives you a chance to earn your fee back but also incentivizes you to perform well and grow your trading account.

4. Learning How To Trade The Forex Market

If you are interested in learning how to trade the Forex market, joining a prop company can be an excellent choice. Prop firms often provide comprehensive training programs and educational resources to help aspiring traders develop their skills. These programs cover various aspects of Forex trading, including technical analysis, fundamental analysis, risk management, and trading psychology. With access to experienced mentors and a supportive trading community, you can accelerate your learning curve and gain the knowledge necessary to navigate the complex world of Forex trading.

5. Pros And Cons Of Being A Prop Trader

Before diving into prop trading, it’s important to understand both the pros and cons associated with this career path. Let’s explore them:

Pros:

– Access to significant trading capital without personal financial risk.

– Opportunity to earn a share of the profits generated from your trades.

– Exposure to advanced trading tools, technology, and platforms.

– Continuous learning and mentorship from experienced traders.

– Access to a supportive community of like-minded traders.

– Potential for career growth and advancement within the firm.

Cons:

– Trading performance is closely monitored, and failure to meet targets may result in termination.

– Some prop firms may have strict risk management rules that limit trading strategies.

– Competition among traders within the firm can be intense.

– Splitting profits with the film means your earning potential is dependent on overall performance.

– Adapting to the firm’s trading rules and methodologies may require a transition period.

– Firm’s profit structure, which may be less favorable than trading independently.

6. How Do Prop Firms Work?

Understanding how prop firms operate is crucial before deciding to join one. Proprietary trading firms provide traders with access to their trading infrastructure, including advanced trading platforms, data feeds, and risk management tools. Traders are typically required to go through an evaluation process to showcase their trading skills and strategies. Once accepted, traders receive a funded account and are allowed to trade using the firm’s capital.

Prop firms may have specific rules and guidelines that traders must adhere to, such as maximum position sizes, risk limits, and trading timeframes. These rules are in place to protect both the firm and the traders, ensuring responsible and disciplined trading practices. Read about How To Create An Infallible Forex Trading System here.

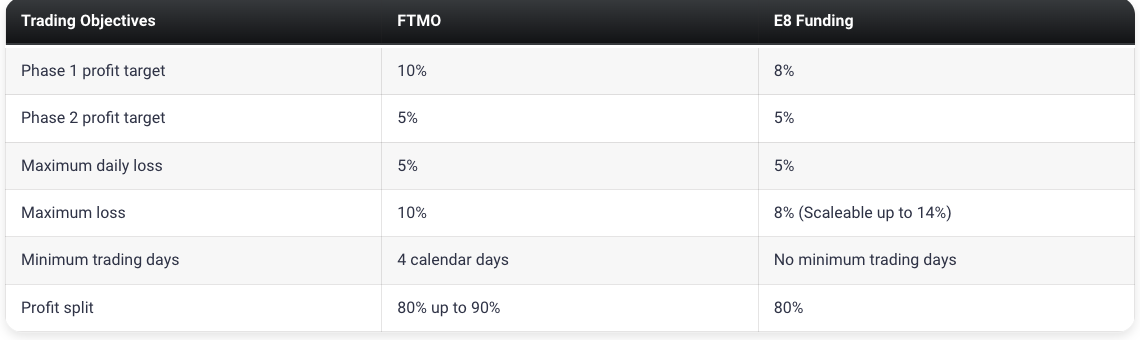

What Sets FTMO Apart From Other Prop Firms?

FTMO stands out from most leading prop firms in the industry by offering a two-phase evaluation program with two different types. Traders can choose between the normal and aggressive account types. Additionally, FTMO is also one of the longest-standing proprietary trading firms in the industry, having been involved since 2015 while remaining one of the most reliable firms to choose from.

Compared to other prop firms, FTMO’s normal evaluation program is a two-phase evaluation program that requires traders to complete two phases before qualifying for funding. The profit target is 10% in phase one and 5% in phase two, with a maximum daily loss of 5% and a maximum drawdown of 10%. Traders are also required to trade for a minimum of 4 days in each phase before being funded. The normal evaluation program also has a scaling plan. Compared to other leading prop firms in the industry, they have above-average profit targets and minimum trading day requirements.

FTMO offers a unique approach to prop trading with its two-phase evaluation program and different account types. It has established itself as a reliable and trusted partner for traders in the industry. Since 2015, FTMO has been a prominent player in the proprietary trading industry, and it continues to be a top choice for traders.

In comparison to other prop firms, FTMO’s two-phase evaluation program presents an exciting journey for traders. To qualify for funding, traders must pass through two phases, each with profit targets of 10% and 5% respectively. There are also maximum daily loss limits of 5% and a maximum drawdown limit of 10%. Additionally, traders are required to trade for at least 4 days in each phase before qualifying for funding. The normal evaluation program also features an intriguing scaling plan. Compared to other top prop firms in the industry, FTMO sets higher average profit targets and minimum trading day requirements.

FTMO is an attractive choice for traders looking to showcase their trading skills and qualify for funding. With its unique two-phase evaluation program and a range of account types available, FTMO remains a top option for traders entering the world of prop trading. FTMO’s reliability and reputation in the industry have been proven over time, making it a trusted partner for traders striving for success in proprietary trading.

In your trading journey, consider FTMO as an appealing option to develop your trading career and achieve success in the world of prop trading.

Example Of Comparison Between FTMO & E8 Funding

Source: forexpropreviews.com

7. Prop Trading Taxes

Taxation is an important aspect to consider when engaging in prop trading. Tax regulations and obligations vary by country and jurisdiction. It’s essential to consult with a tax professional or accountant to understand the tax implications of trading with a prop firm. They can guide how to report your trading profits and handle any tax obligations that may arise.

8. Additional Resources

Source: Talent Canada.ca

To further explore the benefits of joining a prop trading firm, you may find the following resources helpful:

– Traders Union: An informative article on the advantages of joining a prop firm and a list of the best prop trading firms.

– Day Trade the World: An article highlighting the reasons why trading with a prop trading firm can be beneficial.

– Quantified Strategies: A comprehensive guide that explores the pros and cons of proprietary trading.

Let’s Look At Two Popular Prop Firms For Example

SMB Capital

SMB Capital is a proprietary trading firm based in New York City. They are well-known for providing training and funding to traders, both beginners and experienced individuals. SMB offers an extensive training program that includes courses on trading strategies, risk management, and the psychology of trading. They focus on equity, futures, and options trading. One distinctive feature of SMB Capital is that they do not require traders to invest their capital. Instead, they fund traders and share a portion of the profits. The firm is dedicated to mentoring traders and developing their skills, which makes it a preferred destination for many who aspire to build a career in trading.

FTMO

Source: algofxpro.com

FTMO is another proprietary trading firm, but it’s based in Prague, Czech Republic. Similar to SMB Capital, FTMO also provides funding to forex traders. They offer a unique challenge to traders, where traders have to prove their skills and consistency by managing a demo account successfully under predefined conditions. Once traders pass the challenge and verification process, they are given a funded account to trade. FTMO covers the losses on these accounts, but they take a portion of the profits. What sets FTMO apart is its focus on the Forex market and its unique challenge structure. They provide educational content, performance psychology, and analytical apps to assist traders.

Both SMB Capital and FTMO demonstrate different approaches to the same goal – supporting and cultivating successful traders. SMB Capital offers an intensive, immersive training program and mainly focuses on the U.S. market, while FTMO uses a unique challenge system and focuses primarily on Forex trading. Both firms eliminate the need for traders to risk their capital, which can be a significant advantage for individuals breaking into the trading industry. By doing this, they not only remove a substantial barrier to entry but also create an environment where traders can focus purely on improving their trading skills.

Conclusion

Joining a prop trading company can be an excellent opportunity for individuals interested in learning how to trade the Forex market. With access to trading capital, flexible payment terms, and a supportive trading community, prop firms provide an environment conducive to skill development and growth. However, it’s important to carefully consider the pros and cons associated with prop trading and align them with your trading goals and preferences. By making an informed decision, you can embark on a rewarding trading journey and take advantage of the unique benefits offered by prop trading firms.

Remember, prop trading is a challenging endeavor that requires discipline, continuous learning, and adaptability. As you explore the world of prop trading, always strive to expand your knowledge, refine your strategies, and maintain a proactive approach to enhance your trading performance. Happy trading!