Table of Contents

- 1. How To Create An Infallible Forex Trading System

- 2. STEP BACK FROM TRADING FOR A SECOND AND TALK ABOUT MARTIAL ARTS

- 3. ENOUGH TALK ABOUT MARTIAL ARTS, LET’S GET BACK TO TRADING

- 4. SHORT TERM VS LONG TERM

- 5. MECHANICAL VS DISCRETIONARY

- 6. ECONOMIC NEWS BASED

- 7. INDICATOR VS PRICE BASED

- 8. STYLE BASED

- 9.HOW I CREATE MY INFALLIBLE AND PROVEN RULE BASED TRADING SYSTEM

- 10. OTHER RULES THAT ARE OUTSIDE THE SYSTEM SHOULD INCLUDE

How To Create An Infallible Forex Trading System

When it comes to trading, most traders started their journey in search for the “perfect” system and the best forex trading strategies, only in a matter of time will they find out, that they are the creator of such a system. I know it sounds cliche but it’s something which I have personally experienced. The endless search for the perfect system and the continuous tweaking and optimizations – you name it, I’ve done it.

Traders think that finding the best forex trading system is the one stop solution to ALL their trading problems, which can’t be further than the truth. We won’t cover psychological aspects here, but believe me, it’ll be the biggest contribution to your trading success. The discipline to not over-trade, the fearless execution, revenge-free trading, not jumping on a move that you’ve missed out and so on..

SELLING forex trading strategies for beginners and systems has indeed been proven to make you lots of money. Don’t believe me? Search “forex trading system” or “forex trading strategy that works” on Youtube and see how many views those videos have. Marketers are always thinking of making a quick buck from the next system hunter out there. In The Complete Price Action Course I’ve created, my goal is to get you exposed to all the tools that can help you craft your own system, rather than giving you one. It comes down to finding the right system for the right personality – which is your own. ( Read more about Price Action Forex Trading )

LET’S STEP BACK FROM TRADING FOR A SECOND AND TALK ABOUT MARTIAL ARTS.

I see a lot of similarities between learning how to trade and learning martial arts. Just like martial arts, you started off by choosing the ultimate infallible martial art which you’d like to dedicate the rest of your life to. You’d watch all the gurus’ demonstration, the fighters from each discipline fighting it out and finally you decide to pick one for yourself. After a while, you’ll come across another shiny move and you decide to take it up as well. Don’t get me wrong, this is completely normal and I believe it’s part of the learning process, just like traders who mindlessly jump on to the next shiny object. The point is, you have to learn what works for you.

“You learn from different gurus and teachers, you take what works FOR YOU and omit the rest.”

Depending on certain characteristics that you have, such as how flexible you are, how good your stamina is, how long your arm reach is and your body weight, you’d need to adapt what you’ve learnt to make it work for you in the various battlefields (with your own discretion), depending on the strength of your opponents as well.

At the end of the day you’ll come back to the basic strikes, techniques and your strengths. (Just like trading which comes down to entries, exits and money management)

ENOUGH TALK ABOUT MARTIAL ARTS, LET’S GET BACK TO TRADING.

So let’s break down a trader’s personality and see how they can contribute to a trader’s strength or weakness.

SHORT TERM VS LONG TERM

Designed by macrovector / Freepik

Not everyone has the patience to trade off the daily charts. Some prefer looking at shorter time frames, a.k.a intra-day trading. Prices move a lot faster there and in couple of minutes / hours, you’ll be able to bank in small chunks of profits or take a loss – instant gratification. Watch the screen for a few hours and go home to a good night’s rest. Others who are more investor minded, who prefer to bank in bigger amounts, can hang on to their position for weeks to months. This separates the time frame you’ll be looking at.

MECHANICAL VS DISCRETIONARY

Designed by macrovector / Freepik

One set up with fixed variables. For example, someone who wants to take a breakout trade mechanically would wait for the ADX indicator to signal that it’s trending and use a 200 Moving Average, 50 MA and 10 MA and wait for them to be aligned before taking a trade. A discretionary trader can jump the gun, just because he sees a particular price action / candlestick setup which cues that a breakout is likely.

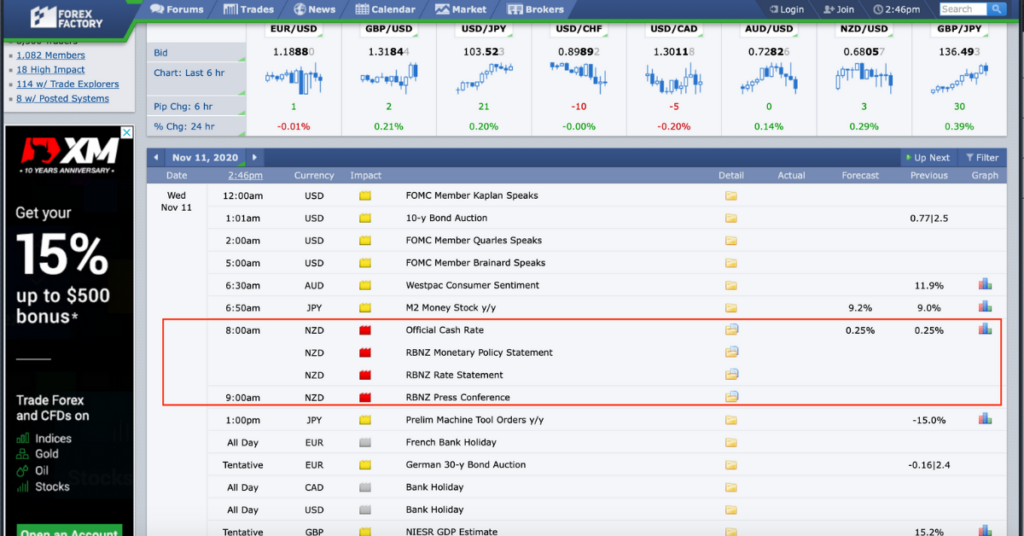

ECONOMIC NEWS BASED

Only watch the charts when there is a red news in action. (source: ForexFactory.com)Trading off economic news was a thing when I first started back in 2006. It’s not really applicable anymore today as the spread gets too wide right before the release and it’s hard to get filled cause Forex brokers aren’t too fond of this method. This is still widely practiced in stocks however.

INDICATOR VS PRICE BASED

One may create his own indicator or simply use an existing one to base his trading decisions on. A popular choice is the MA cross and one may take a buy or a sell when a longer MA inter-crosses with a shorter MA. I prefer looking at price structures as indicators are lagging. I find that higher highs and lows or lower highs and lows as well as candle bodies and wicks display a lot of information and clues as to where price is likely headed to. I use a combination of both price action and indicator.

STYLE BASED (THE FOUR STYLES OF TRADES YOU SHOULD KNOW)

One may choose to take only range bound or trend following trades and ignore counter-trend trades as they are riskier, for example. Others may prefer sticking to breakout trades as they can produce massive profits especially if it’s the beginning of a prolonged new trend. Keep in mind that the market ranges 80% of the time and only trends 20% of the time. I personally seldom take counter-trend trades as I’m more of a pullback trader.

The above personality/traits are just some factors to consider before you craft your own system. You need to get to know yourself first, what your preferences are and from there create a system.

READY? SO HERE’S HOW I CREATE MY INFALLIBLE AND PROVEN RULE BASED TRADING SYSTEM.

I hope you’re still around and I haven’t bore you out. After all this talk, how do I trade, you may ask. I’m a discretionary price action trader. I use a hint of discretion in my direction bias and stick to my rules for the execution process.

Unlike algorithmic/mechanical trading, which is strictly rule based without any discretion, my method is a blend of both and it boils down to these simple rules:

What’s my direction bias? – I use multiple time-frames for this. You need to be able to look at things from different perspectives. Where you are in the smaller time-frame (H1) in comparison to the daily, which is a more significant time-frame. If I see a candle turn (watch video about candle turns) on the daily, this usually sets the bias for the next few days. I’d only take trades in the direction of the bias.

How do I want to participate? – I use the H1 for this. This works for me as I’d only need to look at the charts a couple times a day and on average there is 1 setup per day, per chart. I love participating in pullbacks. After a trend has formed on the H1, it has to pause and make a dip or a rally and that’s usually where I’ll participate. Stop trying to take all trades in every direction. Choose the style which you like best.

What do I need to see (THE TRIGGER) – Trade what you see. At this point, your mind will play all sorts of tricks on you. I draw my supply/demand levels manually and use a CCI oscillator. I’d wait for it to become either overbought or oversold before jumping the gun. For more confirmation, I’d wait for a regular or hidden divergence to form. The CCI becomes my trigger.

The exit – In most cases, I’m able to bank in more than a 2R, just because I enter on a pullback. I like targeting the 00 and 50 levels for exits. A positive reward to risk ratio plays a huge role in the overall trade statistics and will improve your performance should your win rate falls below 50%. Read about the different trading platforms offered by brokers here.

OTHER RULES THAT ARE OUTSIDE THE SYSTEM SHOULD INCLUDE:

- The maximum number of trades you’d allow yourself to take per day (this is to prevent over trading)

- A predefined risk % allocated to each trade (1-2% should be ideal)

- The specific pairs you’ll be trading. (I recommend sticking to 1 or 2 pairs)

After everything has been said and done, it’s not 100% win proof. It’s still a proven Forex trading system to me as in the long run, I still win and my equity curve rises up. I still have losses and I’m able to accept them. My winning trades far outweigh my losing trades. I hope this article brings some clarity for those of you who are still in search for Forex trading strategies.

I thank you and appreciate your time for reading and I wish you luck and success in your trading journey! Feel free to shoot me a message if you have any questions!